Analyzing Global Property Market Dynamics

The global property market is a complex and ever-evolving landscape, shaped by a myriad of economic, social, and technological forces. Understanding its dynamics requires a comprehensive look at how different regions and sectors interact, influenced by factors ranging from local housing demands to international investment flows. This article delves into the key elements that drive the global property sector, exploring its multifaceted nature and the various considerations for stakeholders worldwide, offering insights into current trends and future outlooks.

The global property market is a significant component of the world economy, reflecting and influencing broader economic conditions. Its dynamics are continuously shaped by factors such as population growth, urbanization, interest rates, and geopolitical stability. Analyzing these global trends reveals a diverse market with varying performance across continents and countries. For instance, some regions experience robust housing demand and property value appreciation, while others face stagnation or decline due to specific economic challenges or oversupply. International investment flows play a crucial role, with capital often seeking opportunities in stable markets or emerging economies showing strong growth potential. Understanding these overarching movements is essential for anyone involved in property investment or development.

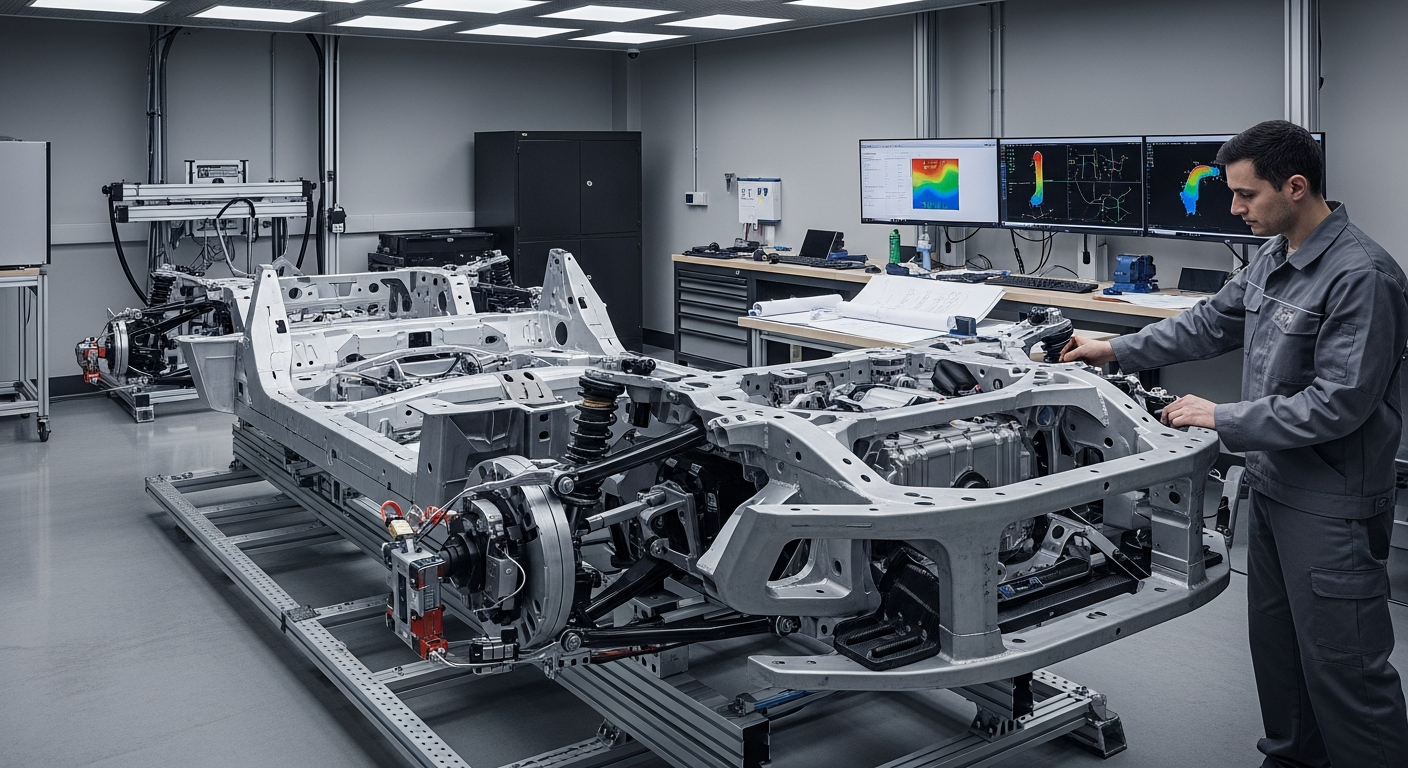

Factors Influencing Urban and Residential Development

Urban and residential development are profoundly influenced by demographic shifts and the ongoing trend of urbanization. As more people migrate to cities, the demand for housing and supporting infrastructure intensifies. Effective urban planning becomes critical to manage this growth, ensuring sustainable development and livable communities. This involves strategic allocation of land for various uses, from residential areas to green spaces, and the development of robust infrastructure, including transportation networks, utilities, and public services. Local housing policies, zoning regulations, and building codes also significantly impact the pace and type of development, aiming to balance affordability with quality of life. These elements collectively shape the housing supply and accessibility in urban centers.

Commercial Assets and Investment Strategies

The commercial property sector encompasses a wide range of assets, including office buildings, retail spaces, industrial warehouses, and hospitality venues. Each segment responds differently to economic cycles and consumer behavior. For example, the rise of e-commerce has reshaped demand for retail assets while boosting the industrial logistics sector. Investment strategies in commercial property often involve substantial finance, with institutional investors, pension funds, and private equity firms playing major roles. These investors seek stable returns and capital appreciation, often diversifying their portfolios across different asset classes and geographies. Market analysis for commercial assets involves assessing vacancy rates, rental yields, and future development pipelines to identify opportunities and manage risks.

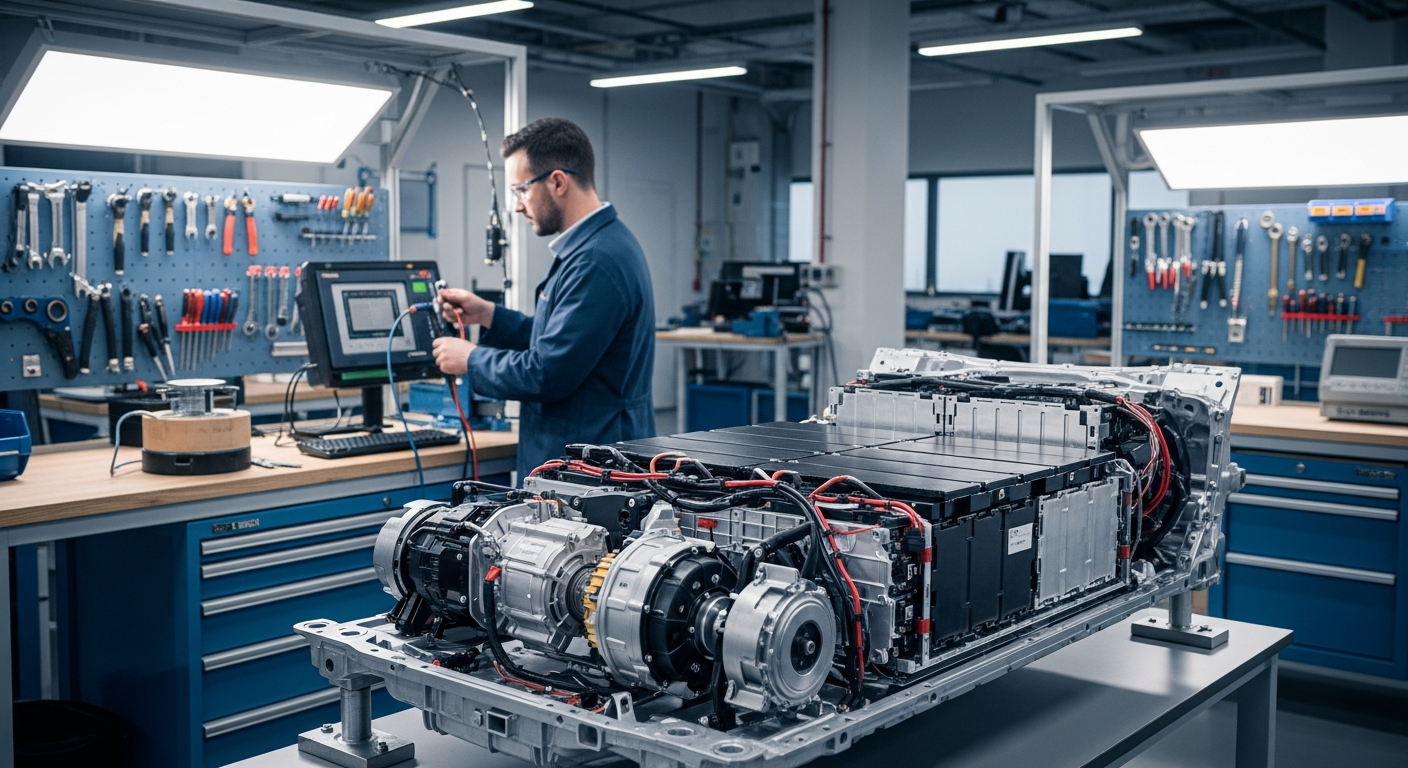

The Role of Technology and Sustainability in Property

Technology is rapidly transforming the property sector, giving rise to ‘PropTech’ innovations that enhance everything from property management and transactions to building design and construction. Digital platforms, virtual reality tours, and data analytics tools are streamlining processes and improving decision-making for buyers, sellers, and developers. Alongside technological advancement, sustainability has become a paramount consideration. There is a growing emphasis on green building practices, energy-efficient designs, and the use of sustainable materials to reduce environmental impact and operational costs. Investors and occupants increasingly prioritize properties with strong environmental, social, and governance (ESG) credentials, driving a shift towards more eco-conscious development and ownership models.

Valuation and Ownership in the International Context

Property valuation is a complex process that varies significantly across international markets due to differences in legal frameworks, economic conditions, and cultural practices. Methods like comparative sales analysis, income capitalization, and cost approach are adapted to local contexts. Understanding property ownership structures, such as freehold, leasehold, or commonhold, is crucial when engaging in cross-border transactions. These legal distinctions dictate rights, responsibilities, and the duration of ownership. Navigating the international property landscape also involves understanding diverse finance options, tax implications, and regulatory environments, which can present both opportunities and challenges for global investors seeking to acquire or develop assets in foreign markets.

The global property market is characterized by its dynamic interplay of local specificities and international forces. From the intricate details of urban planning and residential housing needs to the broad strokes of commercial investment and technological integration, every aspect contributes to its overall complexity. The evolving nature of this market, driven by demographic shifts, economic policies, and a growing emphasis on sustainability, necessitates continuous analysis and adaptation for all stakeholders involved in development, ownership, and finance worldwide.