Challenges and Opportunities in Global Housing

The global housing landscape is a complex tapestry woven with diverse economic, social, and environmental threads. From bustling metropolises to serene rural areas, the demand for shelter continues to evolve, presenting both formidable challenges and significant opportunities for development. Understanding these dynamics is crucial for policymakers, investors, and individuals alike, as they navigate the intricate pathways of property acquisition, urban expansion, and sustainable living in an ever-changing world.

Global Housing Development and its Challenges

The continuous growth of the world’s population, coupled with increasing urbanization, places immense pressure on housing development across various regions. Many cities grapple with providing adequate and affordable property for their residents, leading to issues such as informal settlements and housing unaffordability. Challenges include land scarcity, regulatory hurdles, and the rising cost of construction materials, which can impede the pace and scale of necessary development projects.

Furthermore, the quality and accessibility of existing housing stocks vary significantly. Addressing these disparities requires concerted efforts in planning and resource allocation. Innovating construction methods and exploring alternative housing models are essential steps to overcome these obstacles and ensure that a broader segment of the population has access to safe and suitable living conditions.

Dynamics of the Global Housing Market and Investment

The global housing market is influenced by a myriad of factors, including interest rates, economic stability, demographic shifts, and government policies. Investment in residential and commercial property remains a significant component of the global economy, attracting both institutional and individual capital. Fluctuations in these markets can have far-reaching implications, affecting everything from individual wealth to national economic performance.

Understanding the cyclical nature of real estate markets and the impact of macroeconomic indicators is vital for informed decision-making. Investors often seek opportunities in emerging markets or resilient urban centers, while also considering diversification strategies to mitigate risks associated with market volatility. The interplay between supply, demand, and economic health dictates the overall trajectory of real estate investment returns.

Urban Planning, Infrastructure, and Sustainability in Housing

Effective urban planning is paramount in shaping livable and functional communities, especially in rapidly expanding cities. This involves strategic allocation of land for residential and commercial use, development of robust infrastructure like transportation networks, utilities, and public spaces. The goal is to create environments that support social well-being and economic activity while minimizing environmental impact.

Sustainability has become a central focus in modern housing initiatives. This includes integrating green building practices, promoting energy efficiency, utilizing renewable resources, and designing resilient structures that can withstand environmental changes. Sustainable urban development aims to balance the needs of the present without compromising the ability of future generations to meet their own needs, fostering long-term ecological and social health.

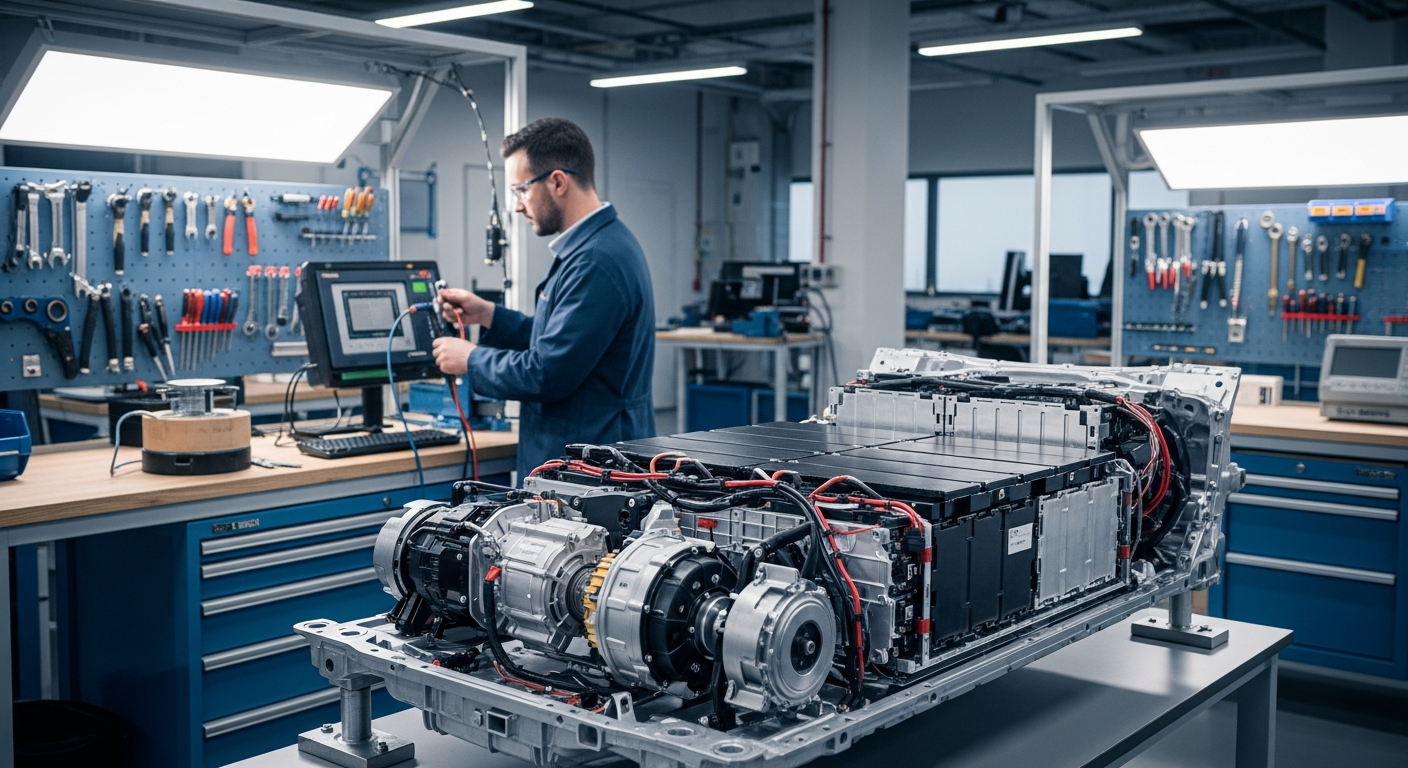

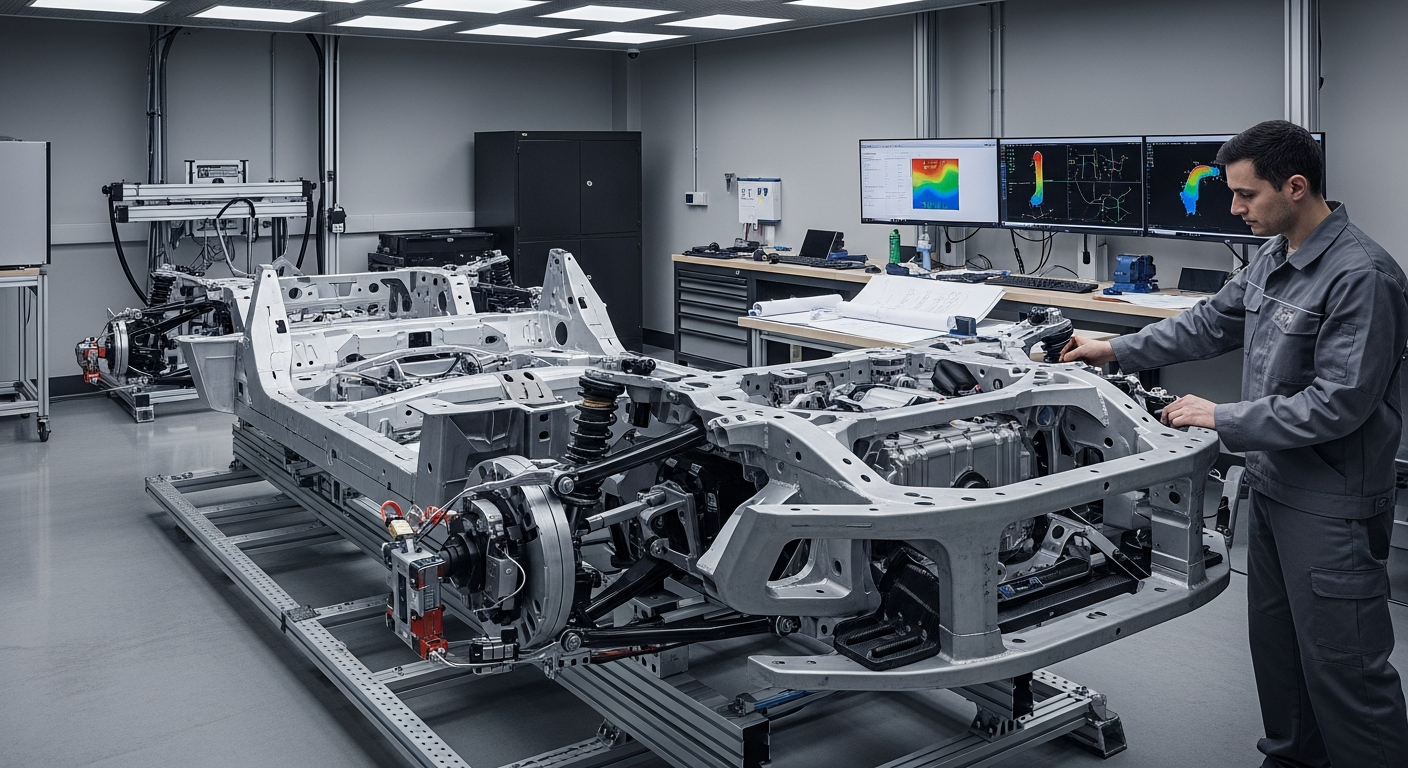

Innovations in Architecture and Future Housing Trends

The fields of architecture and construction are constantly evolving, driven by technological advancements and changing societal needs. Innovation in design, materials, and building techniques is leading to more efficient, adaptable, and aesthetically pleasing homes. Modular construction, 3D printing, and smart home technologies are examples of how the sector is embracing new methods to enhance functionality and reduce environmental footprints.

Looking to the future, several trends are likely to shape housing. These include a greater emphasis on flexible living spaces, co-living arrangements, and multi-generational homes. Digitalization is also transforming how properties are marketed, managed, and even owned, with virtual tours and online platforms becoming more prevalent. These shifts reflect evolving lifestyles and the desire for more personalized and connected living experiences.

Understanding Residential and Commercial Property Valuation

The valuation of property assets is a critical process for both residential and commercial real estate, influencing transactions, financing, and investment decisions. While both categories involve assessing market value, the methodologies and factors considered often differ significantly. Residential property valuation typically focuses on comparable sales, location, size, and amenities relevant to individual homeowners.

Commercial property valuation, conversely, often emphasizes income-generating potential, lease structures, tenant quality, and overall market demand for specific business uses. Factors such as cap rates, net operating income, and potential for future development play a crucial role. Accurate valuation is essential for fair pricing, risk assessment, and strategic portfolio management across the diverse spectrum of the global real estate market.

The global housing sector stands at a pivotal juncture, marked by a dynamic interplay of challenges and opportunities. Addressing issues like affordability, sustainable development, and infrastructure demands while embracing innovation in design and construction will be key to shaping the future of living spaces worldwide. A comprehensive understanding of market forces, urban planning principles, and evolving consumer needs will continue to guide responsible growth and investment in this essential sector.